Business Insurance Agent In Jefferson Ga Fundamentals Explained

Wiki Article

The 6-Second Trick For Insurance Agent In Jefferson Ga

Table of ContentsSee This Report on Business Insurance Agent In Jefferson GaThe Main Principles Of Business Insurance Agent In Jefferson Ga Business Insurance Agent In Jefferson Ga - QuestionsThe Definitive Guide to Life Insurance Agent In Jefferson Ga

, the typical yearly expense for a vehicle insurance policy in the United States in 2016 was $935. Insurance additionally assists you prevent the devaluation of your automobile.The insurance policy safeguards you and assists you with cases that others make versus you in crashes. The NCB may be offered as a discount on the premium, making automobile insurance policy more economical (Insurance Agency in Jefferson GA).

Several variables impact the costs: Age of the automobile: Oftentimes, an older vehicle costs much less to guarantee compared to a more recent one. New cars have a greater market value, so they set you back more to repair or replace.

Danger of burglary. Particular vehicles routinely make the often taken checklists, so you might have to pay a greater premium if you have one of these. When it involves car insurance policy, the three major kinds of plans are obligation, collision, and comprehensive. Mandatory obligation protection spends for damage to one more chauffeur's automobile.

Getting My Insurance Agency In Jefferson Ga To Work

Motorbike protection: This is a plan particularly for bikes since car insurance coverage doesn't cover bike crashes. The advantages of car insurance policy far outweigh the threats as you could finish up paying thousands of bucks out-of-pocket for a crash you cause.It's usually far better to have even more coverage than inadequate.

The Social Safety and Supplemental Safety and security Income disability programs are the largest of numerous Federal programs that give help to people with disabilities (Home Insurance Agent in Jefferson GA). While these 2 programs are different in many means, both are administered by the Social Safety Administration and just people that have a disability and satisfy clinical criteria may get benefits under either program

Utilize the Conveniences Eligibility Screening Device to find out which programs might have the ability to pay you advantages. If your application has recently been refuted, the Net Allure is a beginning factor to request a review of our choice about your qualification for special needs benefits. If your application is denied for: Medical factors, you can complete and submit the Charm Demand and Allure Handicap Report online. A succeeding have a peek here analysis of workers' compensation claims and the degree to which absence, morale and employing good workers were issues at these firms shows the favorable impacts of providing health insurance coverage. When compared to companies that did not provide medical insurance, it shows up that using FOCUS caused enhancements in the capability to hire excellent workers, reductions in the number of employees' settlement cases and decreases in the extent to which absence and efficiency were issues for FOCUS organizations.

Life Insurance Agent In Jefferson Ga - Truths

Six reports have been launched, including "Treatment Without Insurance Coverage: Insufficient, Too Late," which finds that working-age Americans without health and wellness insurance coverage are more probable to get insufficient treatment and obtain it also late, be sicker and die quicker and receive poorer treatment when they are in the hospital, even for acute circumstances like an automobile crash.The study writers additionally keep in mind that increasing coverage would likely cause a boost in actual source cost (no matter who pays), due to the fact that the without insurance get concerning fifty percent as much clinical treatment as the privately insured. Health Affairs released the research study online: "How Much Treatment Do the Uninsured Usage, and That Pays For It? - Auto Insurance Agent in Jefferson GA."

The responsibility of supplying insurance policy for workers can be a complicated and in some cases costly job and many tiny organizations assume they can't manage it. What benefits or insurance coverage do you legally need to give?

All About Auto Insurance Agent In Jefferson Ga

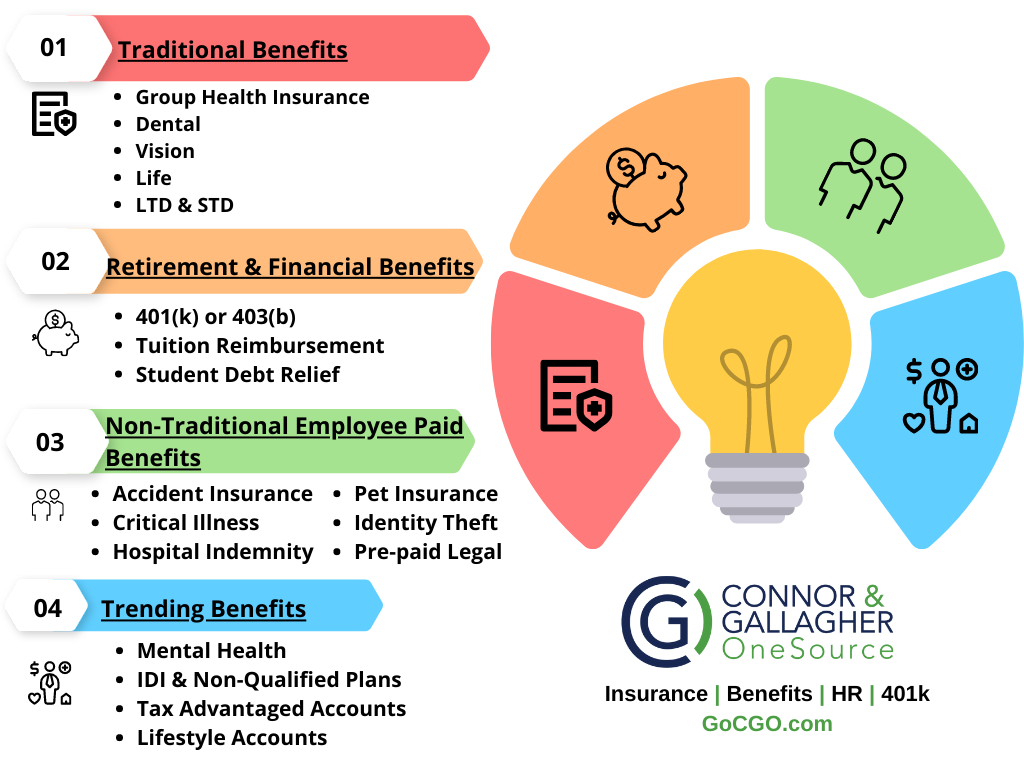

Employee advantages usually start with health and wellness insurance policy and group term life insurance coverage. As component of the health and wellness insurance package, an employer may choose to supply both vision and oral insurance policy.

With the rising pattern in the cost of medical insurance, it is affordable to ask workers to pay a percentage of the insurance coverage. The majority of services do place the majority of the cost on the employee when they provide accessibility to medical insurance. A retirement (such as a 401k, easy plan, SEP) is normally offered as an employee advantage also - https://www.wattpad.com/user/jonfromalfa1.

Report this wiki page